INTRODUCTION TO PROFESSIONAL CREDIT CERTIFICATION

Professional Credit Certification (PCC) is a certification programme in credit for banking practitioners who seek to equip themselves with the skills, knowledge and tools to advance in demanding and rapidly changing field of credit management. By completing the PCC, candidates demonstrate their commitment towards attaining the highest standards of becoming a certified credit practitioner. This certification is developed by Malaysian credit experts to provide greater academic learning with hands-on operational elements, presenting a clear education pathway to becoming credit professionals.

LEARNING OUTCOMES

The qualification aims to produce credit professionals who are able to:

- display a sound understanding of credit management principles and undertake the advanced credit roles and responsibilities of an end-to-end credit management process

- apply and manage broad credit tasks, including accounts management and financial statement analysis, in day-to-day business service activities

- evaluate and resolve complex credit tasks within a range of complex situations to improve the performance of banking services and maintain good credit standings for clients.

TARGET AUDIENCE

- Entry-level banking executives who aspire to advance in the credit function.

- Banking professionals with several years of experience in the credit function.

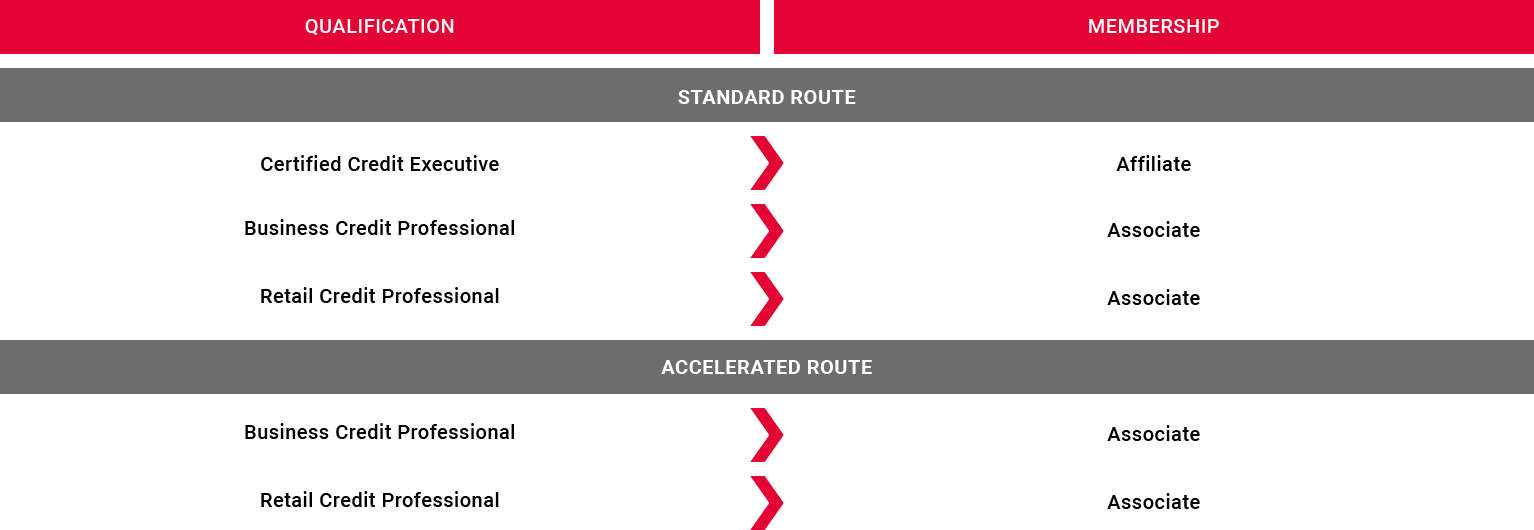

CERTIFICATION PATHWAYS

For certification pathway details, click here.

ENROLMENT

Candidates are required to submit the prerequisite supporting documents for enrolment.

For full details on documentation, click here.

MEMBERSHIP AND PROFESSIONAL DESIGNATION

Members who have completed the PCC programme will be upgraded to ‘Associate’ status and are entitled to use the membership designation, ‘Associate, AICB’. Click here to find out more.

MODULES

Click here to view the PCC modules.

ASSESSMENT

Click here for more information on the assessment format.

EXAM

Click here for more information on examinations.